How To Check Company Credit Scores

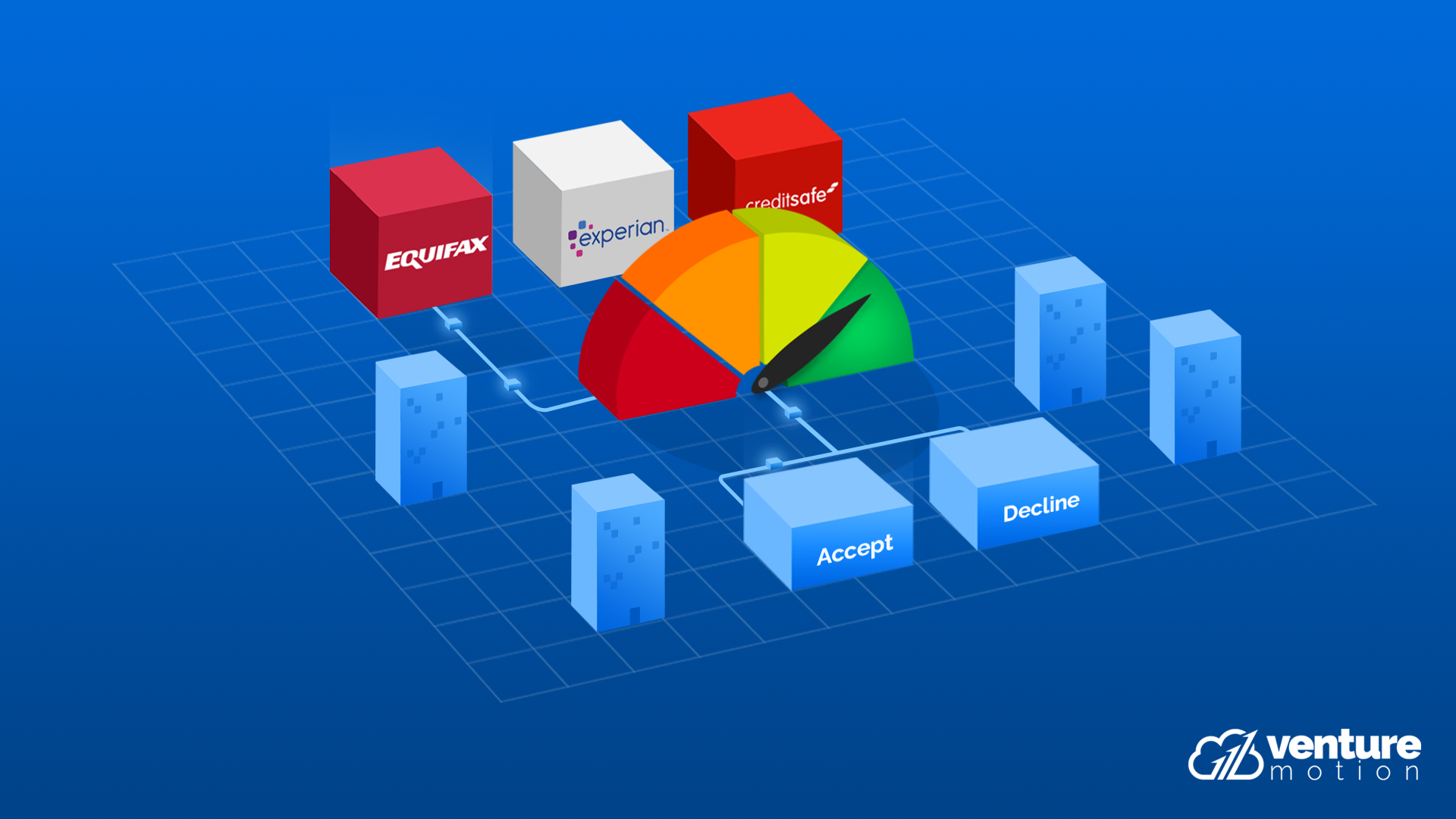

Checking credit scores through agencies such as Experian, Equifax or Creditsafe is often an essential part of the operation of many different businesses. When most people think of credit scores, however, they likely think of the individual credit checks required before taking out a loan or financing a product. However, company credit scores are just as, if not more, important.

In this article we’ll be looking at why offering excellent company credit check services is so important and how you can easily check company credit scores with our fully integrated LendTech platform.

Why company credit checks are so useful

As a company operating in the B2B lending sphere, understanding your consumers is essential. Before offering financial services to the businesses you work with, it’s imperative that you have an idea of their financial histories. That’s where company credit checks come in.

Company credit checks are often even more important than personal ones, primarily due to the generally higher value of loans being offered to companies. But with these larger loans, even more accuracy is required during the approval process.

Company credit checks provided by major credit agencies give you the ability to perform highly accurate checks on the financial history of any company. With this highly accurate data at your disposal, you can approve or deny applications for your financial services with confidence.

Company credit checking agencies

The top company credit agencies in the UK include the likes of Experian, Equifax and Credit Safe. All of these companies have access to millions of records of highly accurate, up-to-date company financial data accessible through their APIs.

Once the value of the company credit data held by these agencies is recognised, implementing them into your own loan approval process becomes almost essential. Full API integration is the best way to ensure your business can effectively perform Equifax, Credit Safe or Experian company credit checks.

Once integrated, the APIs will allow your existing loan application approval systems and underwriters to easily access the company credit data necessary to make informed lending decisions.

How to perform company credit checks with Venture Motion

Integrating and utilising company credit check APIs within your systems can be a daunting task. But when you work with Venture Motion, we guarantee that the process is entirely seamless, while also providing you with an easy-to-use dashboard, putting the power of the APIs directly into your hands.

When integrated as part of our LendTech automation platform, you’ll actually be able to automate the entire company credit check process. LendTech allows the APIs we integrate to automatically acquire the credit checking data you need. This data is then put through our decision engine to produce full reports that can automatically approve or deny applicants.

Click the button below to start building your own company credit checking solution today.