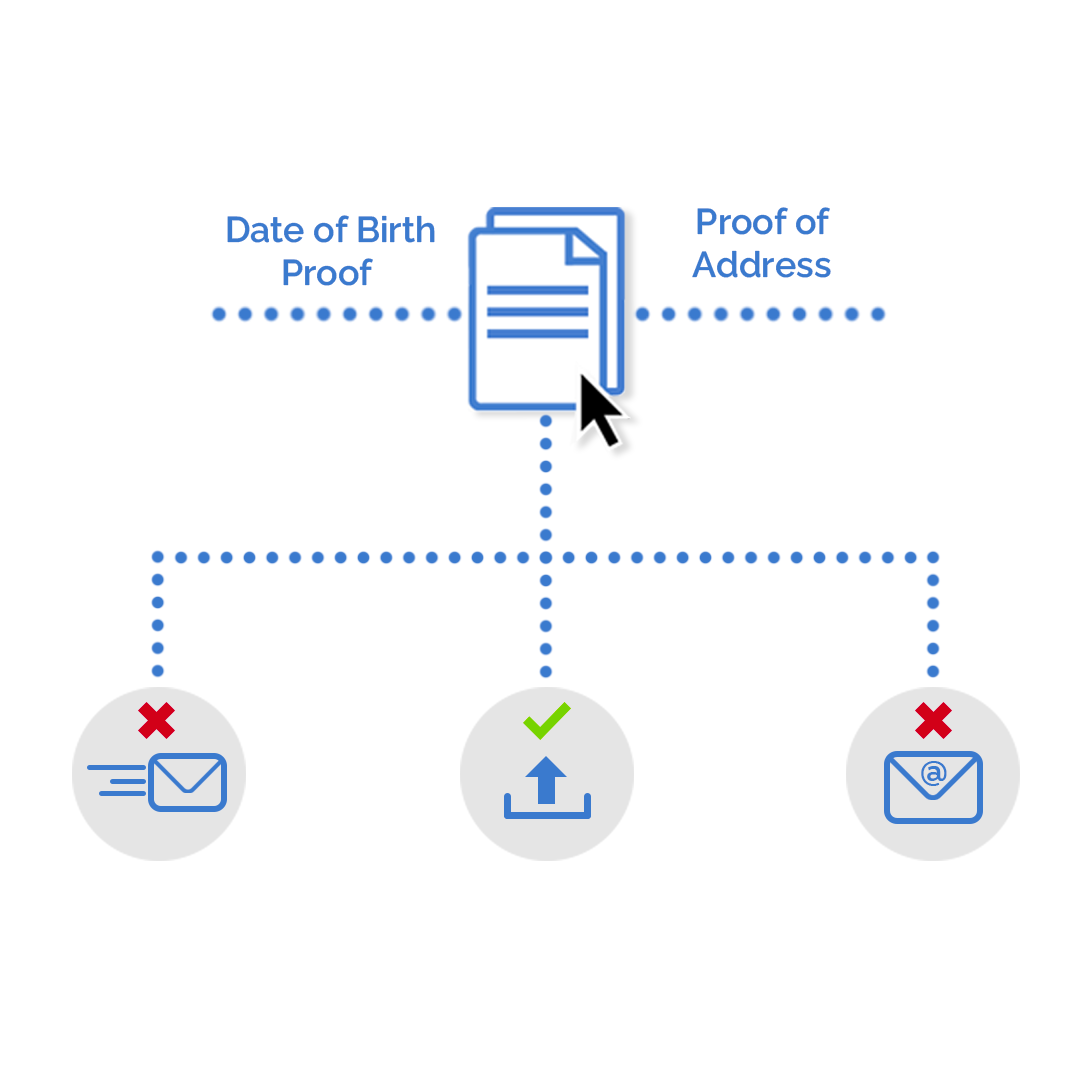

When potential customers apply for the financial services offered by your company, it’s likely that there are a few documents that you’ll need to approve them. Whether these documents involve proving applicants date of birth, proof of address or any other necessary information, the way you receive the information can have a great impact on the operation of your business.

When requesting these documents, many financial service providers will ask customers to scan and email the information in, while others will request that applicants submit their documents through the post.

However, relying on email and postal submissions is often not up to task. Whether it’s due to the annoyances caused by managing inmail filing systems, or the lack of speed and security offered by postal applications, there’s almost always a better way.