Why business credit risk scores are so important

Business credit risk scores allow brokers, lenders and other financial institutions to accurately judge the creditworthiness of companies. A good business risk score allows businesses to agree more flexible credit terms, borrow more capital or win new and better business. A low score, on the other hand, could seriously limit the options available to businesses looking to borrow money or expand their business.

For lenders and brokers, having the technology available to perform fast, accurate business credit checks to assess potential risks is essential. But for many financial institutions, the risk assessment process can be arduous.

How to run a business credit risk score

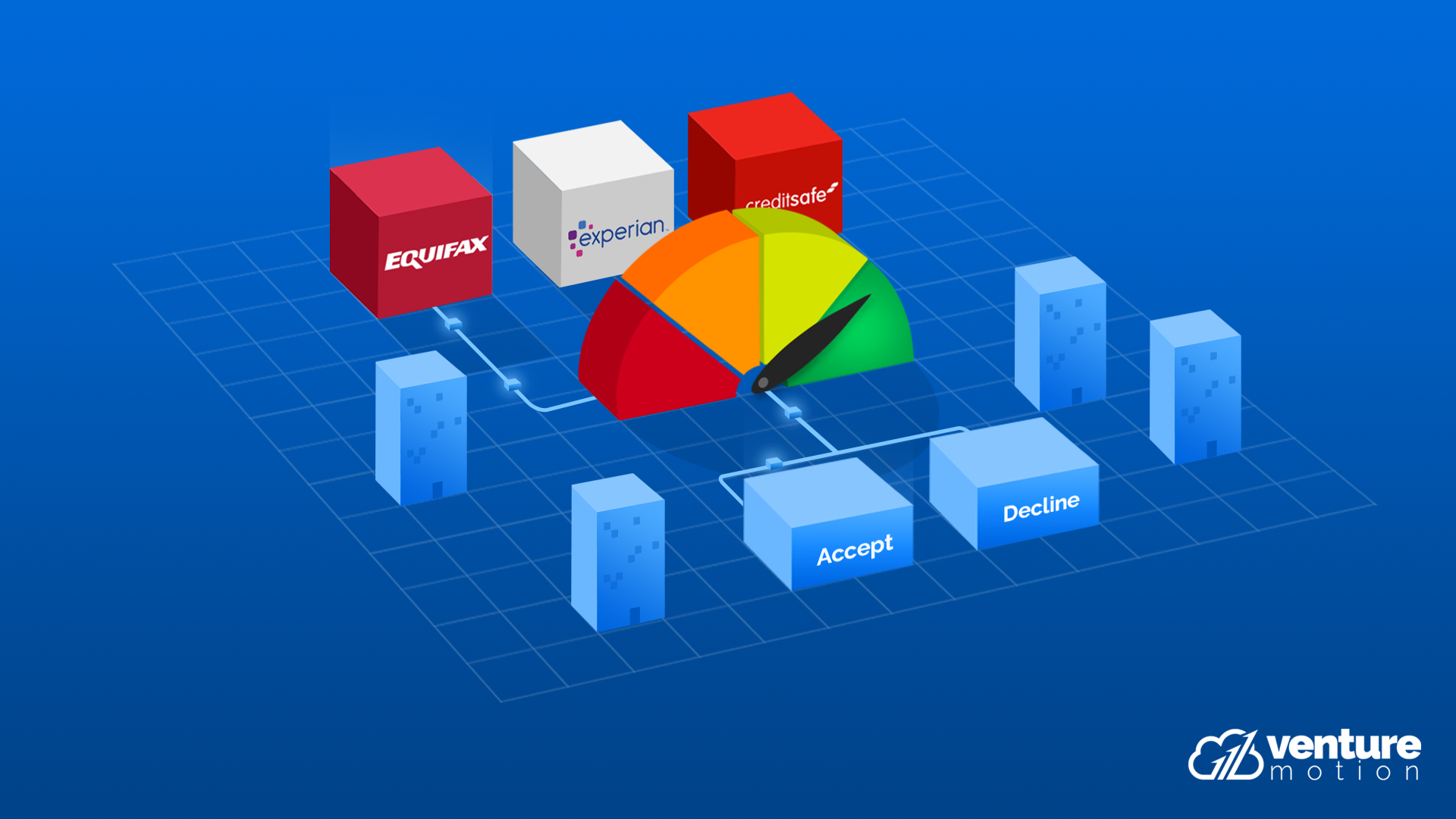

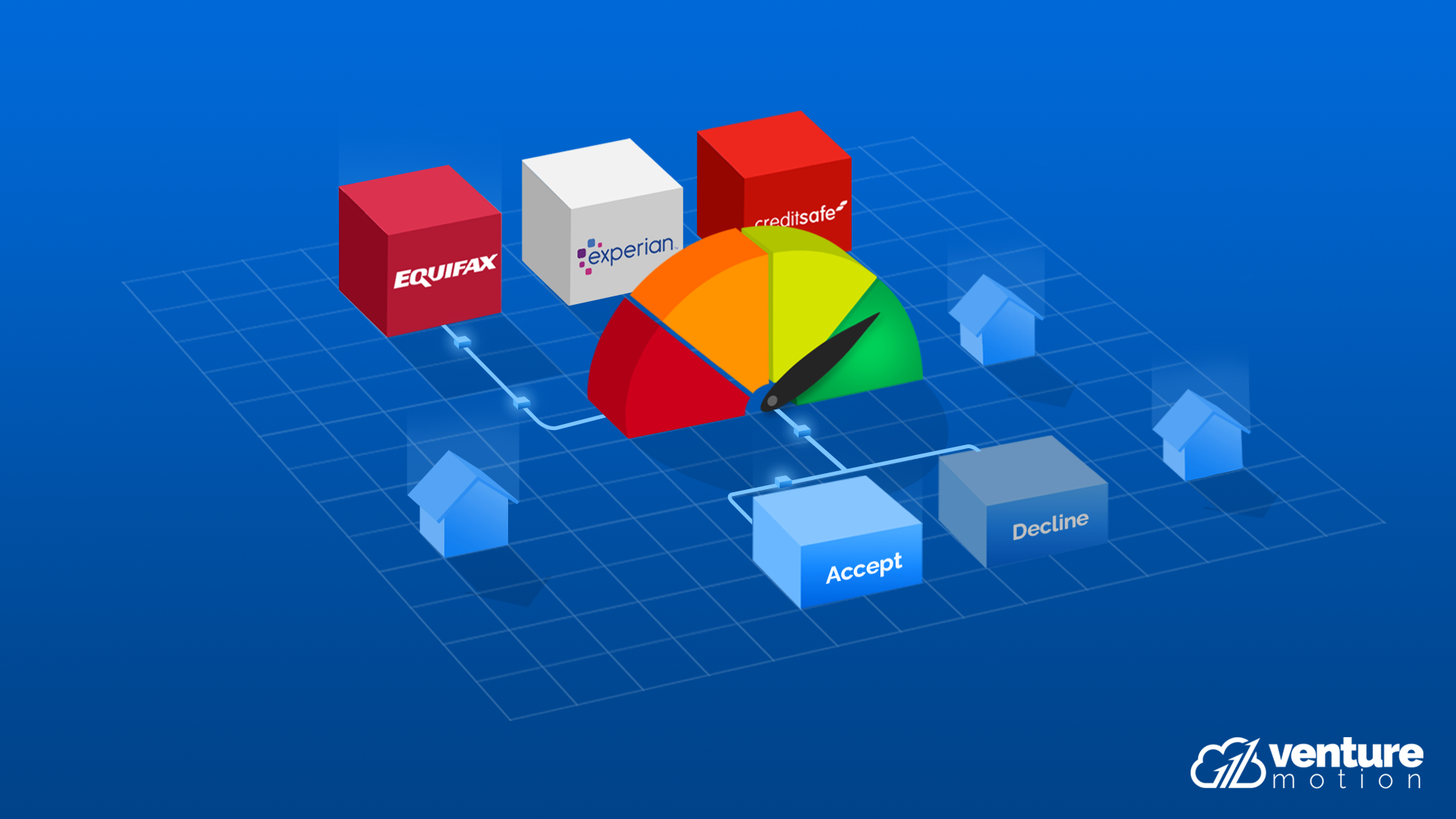

When providing financial services to businesses, being able to assess their creditworthiness and potential risks is a must. There are plenty of providers out there that provide standardised business credit risk scores, including major credit checkers like Creditsafe and Experian.

As a broker or lender, you can utilise the data from these credit checking platforms in a variety of ways. You’ll be protecting your cash flow, avoiding fraudulent companies and – more generally speaking – be making better choices for your business.

Actually processing the data, however, can sometimes be a time consuming process. Manually checking business credit risk data involves looking into how long they have been operating for, whether they have any CCJs, bankruptcy information and even who the directors are and how long they have been with the company. Depending on the services you offer, the data points used to determine a company’s risk could vary wildly. Naturally, this kind of manual analysis can be time and resource intensive and may not be conducive to the efficient scaling of your own business.

Automated business credit risk scoring

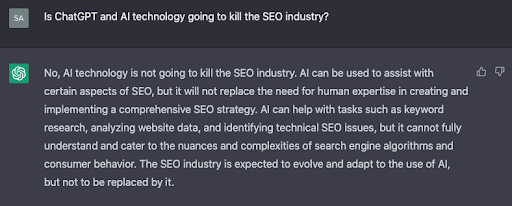

Fortunately, the days of manually scoring the credit risk of businesses is coming to an end, with technology making the process faster, simpler and entirely bespoke becoming more and more accessible.

Utilising the vast resources held by major credit checking agencies, credit risk scoring automations is a huge asset for any industry dealing with other businesses from a financial standpoint. However, until now, it has still been a time-consuming process, leaving underwriting teams and business owners with less time to spend on what matters: building their businesses.

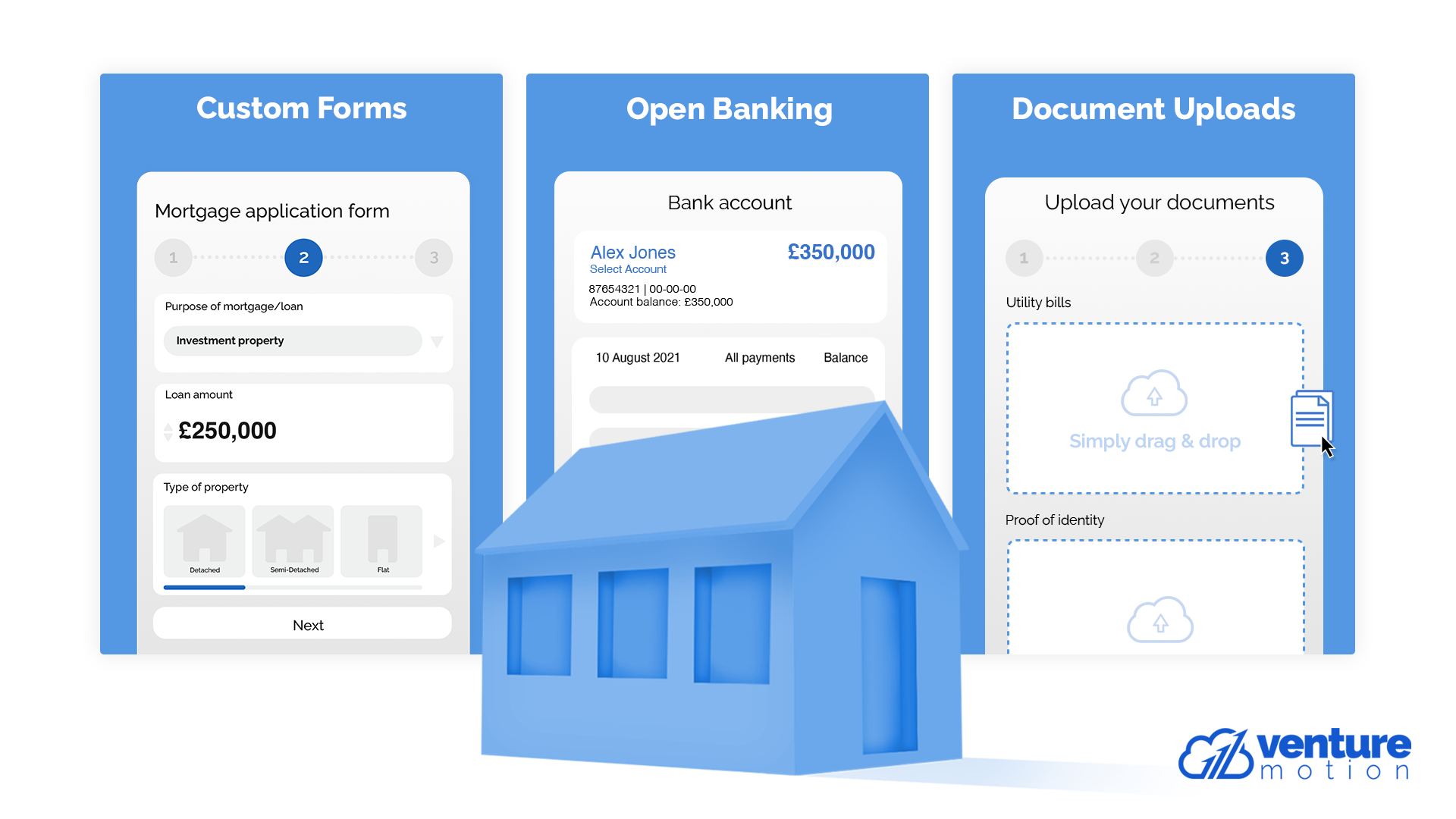

Our own LendTech platform is a powerful AI-driven credit decisioning tool that gives brokers, lenders, underwriters and almost any business offering financial services or products to businesses to automate the entire risk scoring process. With LendTech, businesses are able to choose from a spectrum of data points to ensure that any potential applicant is fully scored against a custom risk criteria. The entire process is incredibly easy-to-use and the risk scoring is completed in seconds.

The future of business credit risk scoring

With a rise in technologies like LendTech, performing risk scoring against businesses will get easier and easier for business lenders. But it is only by adopting automated scoring and similar AI-led technology that lenders, brokers and underwriters will be able to stay ahead of the curve.

By adopting automated business credit risk scoring, your business will make better financial decisions, expand the number of applicants you are able to onboard and, most importantly, give business owners the time and resources to focus on expanding and growing their business to increase profits without increasing headcount.

To find out more about how an automated decisioning platform could transform your business, get in touch with us today.