In the competitive world of business finance, staying ahead of the curve is key.

Whether you’re developing a deep understanding of market trends or effectively performing KYC/KYB analysis, those in the B2B finance industry know how important it is to stay one step ahead of the competition. Of course, if you work in business finance, you know that’s easier said than done.

From hours spent analysing business documentation and credit reports as part of your qualification process, to spending hours on the phone trying to match leads with lenders, making the time to scale your business can feel almost impossible.

If that sounds like the kind of problem you’re facing, you’re not alone. But there may be a solution in automation. Business finance automation takes many forms and can help ensure that every part of the financing process is smoother. From the moment a lead approaches you to getting them onboarded and financed, there’s almost certainly an automation to help make the process cheaper and more efficient.

What is business finance?

In short, business finance is the industry that includes various types of funding options provided to businesses to meet their financial needs. Business finance providers can come in the form of either lenders; financial institutions or individuals that provide funds to businesses in the form of repayable loans. Aside from banks, these lenders are generally categorised as either ‘alternative lenders’ or ‘specialised lenders’.

Alternative lenders include peer-to-peer lenders and online lenders. Unlike traditional banks, these alternative lenders provide relatively fast access to funds and may be more flexible in the criteria they use to determine whether or not to offer loans. Meanwhile, specialised lenders focus on specific types of B2B finance such as asset, invoice or trade financing.

Business finance also covers brokers who act as intermediaries between businesses seeking finance and lenders. Rather than determining their own criteria for financing, brokers are more likely to spend their underwriting and qualification time on determining which lenders are most suited to the businesses seeking finance.

Automation and business finance

Automation technology is becoming increasingly common in more and more industries, and business finance is no different.

One of the most common issues that B2B finance professionals face is the amount of time and resources it takes to process their inbound leads. As with any industry that deals with loans, it’s imperative that business finance providers and brokers work only with businesses that can be relied upon to make their repayments in full and on time.

With high-quality bespoke business finance automations, lenders and brokers can make short work of their due diligence and onboarding process: let’s look at how it works.

Pre-Qualification

While often varying dramatically from organisation to organisation, pre-qualification is essential to B2B finance professionals seeking to work with high-quality leads. However, assessing the creditworthiness of a company during pre-qualification can be a very drawn-out process, particularly with no guarantee of a loan being offered or lender matched at this early stage.

Pre-qualification automations seek to eliminate as much time as possible from this process. With a high quality automation tool, everything from the initial submission of information by the lead through to final approval or rejection by the lender can be handled automatically.

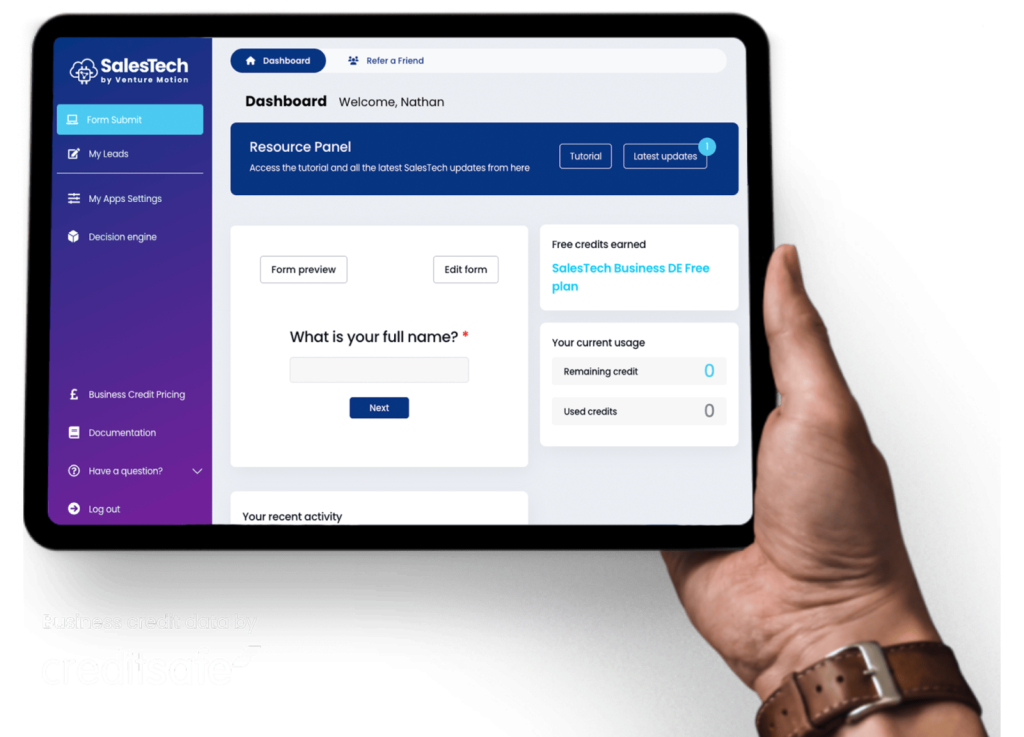

Every automation works differently, so it’s important to ensure that the one you choose is suited to your needs. Our SalesTech automation software does this by utilising data provided by applicants, combined with information pulled from both Companies House and Creditsafe to determine a comprehensive overview of any company’s creditworthiness.

Underwriting

Everyone’s loan underwriting process is unique to their business, so it’s important to ensure that the automation software you choose to use is fully customisable.

Once a lead has gone through pre-qualification, the more in-depth underwriting process can begin. Depending on the lender or broker, this can involve numerous steps running from surface level credit analyses to comprehensive risk assessments based on various factors.

Whatever the case, the underwriting process is often one of, if not the most, time and resource-intensive aspects of onboarding a B2B finance lead. Again, automation technology seeks to give business finance professionals the ability to improve this aspect, while also providing a dramatic boost to your accuracy and consistency, while equipping you with advanced data utilisation, allowing you to underwrite leads with more comprehensive information than ever before.

Pre-Packaging & Lender Matching

A lot of business finance brokers have perfected their qualification and due diligence process. However, when it comes to actually packaging up your deals and ensuring they’re matched with the best lender, the whole process can come to a standstill.

For many B2B finance brokers, packaging and matching leads with each lender’s individual criteria can be the most time-consuming aspect of the whole process. Not only do you have to guarantee the highest degree of accuracy possible when assessing your leads, but you also have to ensure that you fully understand the criteria of the different lenders you work with.

With an effective automation system, you can even simplify the most strenuous aspects of brokering business finance deals.

Utilising data-driven scoring systems that match lead data provided by the potential recipient of the loan, company credit databases and third-party sources like Companies House, a high-quality business finance automation system can constantly match lead data with lender criteria. Plus, by utilising custom forms to acquire data from leads, you’ll have everything you need to package a deal without lifting a finger.

The leads themselves can then be automatically matched to the specific criteria of each lender you work with. This allows you to simply broker the final step, in full knowledge that the suggested lender is the best match for the customer.

Automating your business finance process with SalesTech

Business finance automation can be a game changer for B2B lenders and brokers. Once set up, you’ll see the results of an automation platform instantly: in no time at all you’ll have more time and resources freed up to focus on growing your business.

SalesTech is our business finance automation software that we built to help B2B finance professionals do exactly that.

With SalesTech, you can automate the entire onboarding process, from initial pre-qualification to actually packaging up deals for lenders or onboarding them into your own lending service.

For more information and a demo of how SalesTech works and what it can do for your business, get in touch with one of our helpful product specialists today.