People are often familiar with pre-qualification in terms of mortgages, but it’s also an integral part of the onboarding process for B2B finance organisations. For B2B lenders, finance brokers and other professionals understanding what pre-qualification is, its value and how to enhance it through automation is incredibly beneficial.

In B2B finance, pre-qualification involves the initial assessment of a business’s financial health and creditworthiness to determine its eligibility for a business loan or financing. It’s a process essential for both lenders offering financial services directly, as well as brokers facilitating loans between businesses and lenders.

There are a number of ways through which a business can assess the creditworthiness of a company, including credit checks, Companies House assessments and other methods of determining a business’s financial stability.

The pre-qualification process will vary from company to company depending on the lender or broker’s specific requirements. Overall, however, it will likely involve some variant of the following:

Information submission

The business seeking financing will provide basic information about its financial status. This can include revenue, assets, debts, credit history and more, either through a form or direct communication with the financial institution. The lender or broker may then decide to perform their own credit checks through a business credit agency, or more detailed checks on company information depending on their requirements to offer financial services.

Initial assessment

The financing party will then review the information available to them, judging the applying business’s ability to repay the loan. The lender or broker will make this judgement based on their specific lending criteria, or that of the lenders they work with in the case of brokers. This can be quite a time and resource-intensive process as the lender or broker will have to sort through all of the information available to them to ensure the applying business meets their minimum criteria.

Approval or rejection

Once the business offering financing determines whether or not the applying party has met their criteria, they will either provide them with an initial approval or rejection for the financial product. This is not a formal offer for the loan but, if approved, will allow the applicant to proceed to the next step of the application or onboarding process.

Although the pre-qualification process is an essential part of the onboarding journey for countless B2B financial institutions, it is often a long-winded, resource-intensive procedure. Many applicants will fail the pre-qualification checks, which can make this process disheartening for growing businesses that find it difficult to allocate enough resources to scale their organisation.

This is where automation comes in.

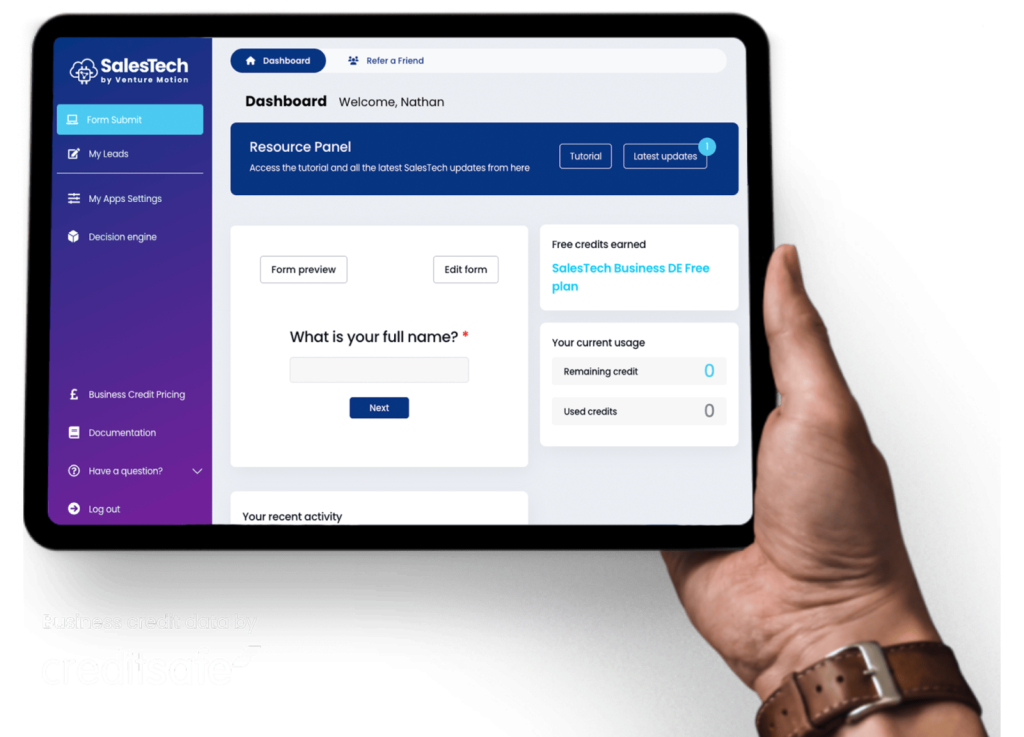

SalesTech is our B2B decision engine software that automates the entire lookup, pre-qualification, due diligence and onboarding process for B2B financial institutions. Our software utilises credit check data from Creditsafe along with Companies House data, matched against the criteria unique to your B2B finance company to approve or reject applicants in a matter of seconds.

When you use SalesTech, you establish the criteria necessary to work with a company and we do the rest. Each applicant will be scored against your bespoke requirements and can be automatically approved or denied so you can allocate your time to more efficiently growing your business.

Knowing if a company has previously filed for bankruptcy is essential to assessing its financial stability. With Companies House, you can view detailed records of the insolvency history of limited companies which…

Knowing if a company has previously filed for bankruptcy is essential to assessing its financial stability. With Companies House, you can view detailed records of the insolvency history of limited companies which…

Knowing if a company has previously filed for bankruptcy is essential to assessing its financial stability. With Companies House, you can view detailed records of the insolvency history of limited companies which…

Knowing if a company has previously filed for bankruptcy is essential to assessing its financial stability. With Companies House, you can view detailed records of the insolvency history of limited companies which…

Knowing if a company has previously filed for bankruptcy is essential to assessing its financial stability. With Companies House, you can view detailed records of the insolvency history of limited companies which…

Knowing if a company has previously filed for bankruptcy is essential to assessing its financial stability. With Companies House, you can view detailed records of the insolvency history of limited companies which…

© Venture Motion Limited 2025