Commercial finance is a competitive and continually evolving industry, which is why it’s so important for lenders and brokers to stay ahead of the competition by adopting new technologies. Brokers, in particular, can find themselves easily bogged down when it comes to packaging and qualifying applicants. In order to deliver a highly accurate service, brokers can spend hours on each deal, leaving them little time to focus on scaling their business.

Automation has the potential to dramatically change the way commercial finance brokers approach their deals, reducing the deal packaging process to a matter of minutes.

Pre-packaged deals

In commercial finance, pre-packaging involves preparing all the documentation and financial details lenders need to know before being able to offer a loan. With a pre-packaged loan, the lender has easy access to a complete and professional package making their assessments smoother and faster.

However, pre-packaging commercial loan applications can be very drawn-out and resource-intensive. From initially collecting the necessary data from applicants, to actually preparing the documents and any final quality checks and lender matching the process can take hours per deal. Add to this the potential of many deals falling through at any number of points during the process and pre-packaging becomes an even more arduous task.

Automation and pre-packaging

Commercial finance automation software can provide brokers with the resources they need to pre-package their deals quickly, efficiently and accurately. Automation software and platforms work in a variety of ways to improve the entire business loan process for lenders and brokers alike, but they often deliver a significant impact on pre-packaging.

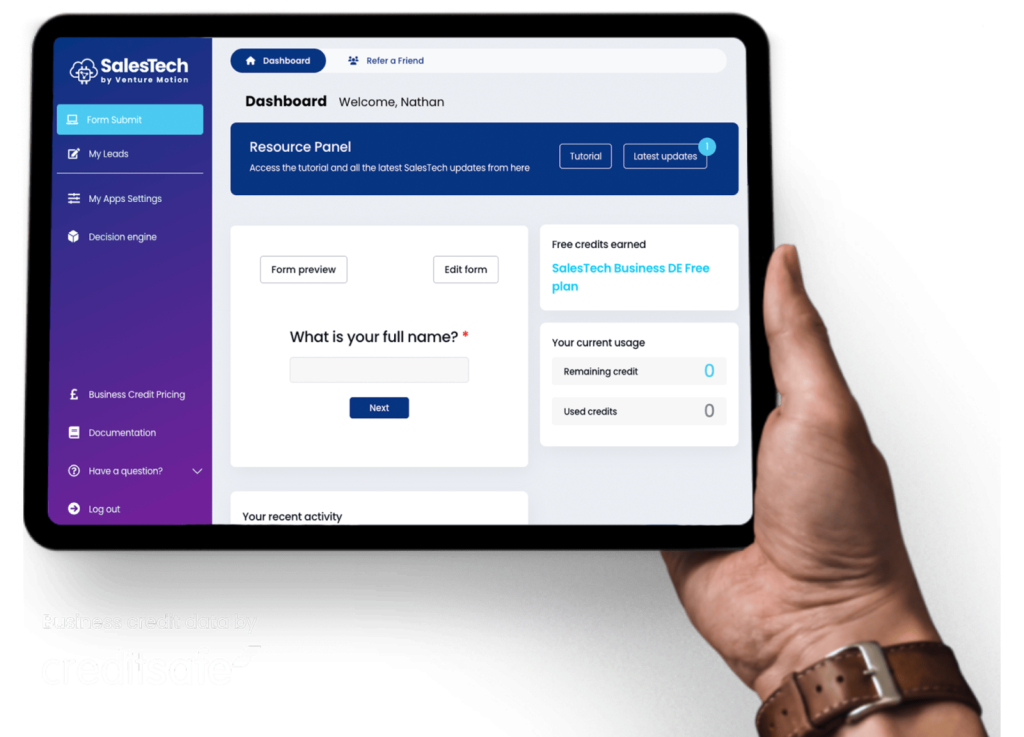

Automation simplifies and speeds up the pre-packaging process. When using commercial finance automation software like our own SalesTech, the platform will handle everything from data collection to compliance checks to even matching deals with relevant lenders.

An effective automation system can entirely change the way brokers do business. Even when you’re not at your desk, SalesTech can pre-package deals 24 hours a day, 7 days a week, even finalising your commercial finance deals while you sleep.

Not only are the deals packaged quickly and with only minor input from the broker, but an automation platform also improves the quality of the packaged deal. With an automated commercial loan process, you can perform quality assurance checks against your pre-defined criteria without the risk of human error. This means that when you match your deals with lenders, you’re guaranteed a highly accurate assessment of the applicant within minutes.

Automating pre-packaging with SalesTech

Our SalesTech software is the perfect tool for commercial finance brokers looking to speed up and increase the accuracy of their pre-packaging and lender matching process. Once set up, you’ll see the results of an automation platform instantly: in no time at all you’ll have more time and resources freed up to focus on growing your business.

To learn how SalesTech can increase the number of applicants your business processes, and streamline your workflow, get in touch with one of our product specialists for a custom automation audit and comprehensive demo.